Category: Financial

-

Why Real Estate Sales Fail: How Agents Can Help Clients

You have decided it’s time to buy a new home. Stop there. Before you start looking and hiring a real estate agent, you must evaluate your financial situation well in advance of applying for a pre-approval letter. We cover the entire process starting about six months out. Let’s eliminate the reasons sales fail. This article offers…

-

Best free and easy accounting for real estate agents

Real estate agents like any other business owner should learn about accounting, taxes, and other aspects of self-employment. This article is about the best free easy-to-use accounting for real estate professionals. You do not need to be a CPA or accountant to manage your finances. We do recommend that you work with a CPA to…

-

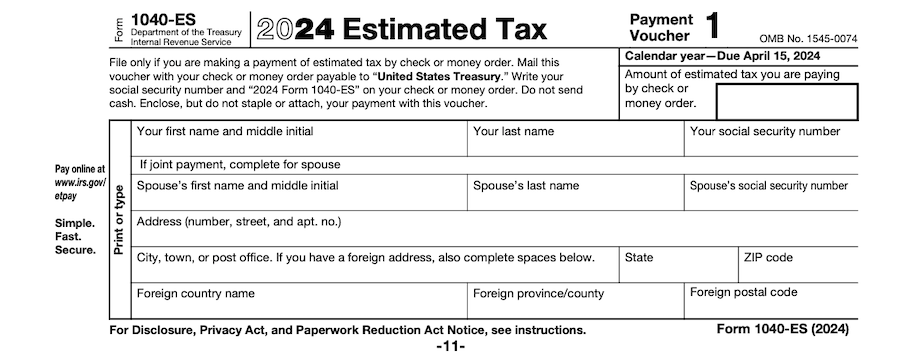

Real Estate agents how to make your tax deposits

Real estate agents are independent self-employed individuals subject to federal and possibly state income tax. You need to make quarterly federal tax deposits and quarterly state income tax deposits if your state has an income tax. I suspect that many real estate agents do not understand the quarterly tax deposit requirement. I know too…

-

Best Real estate agents create your tax plan now

Your tax plan will include making estimated income and self-employment tax deposits. Perhaps the most important part of tax planning is to pay as little as legally possible. This does take planning and knowledge. Your tax planning deadline is December 31st of each year. This article will take you into everything you need to know…

-

How can a real estate agent save for retirement?

Very few real estate agents that I speak with have any idea of how to save for retirement. Retirement savings are critical for real estate agents because they are not earning a pension. Social Security alone will not be sufficient for most people so real estate agents must supplement their retirement income. The good thing…

-

Interest rate buydowns are popular now 2025

While mortgage interest rates are nowhere near a historic high, they are for at least two generations of Americans who have not seen 7%. At the same time as interest rates have risen from historic lows in the 2% range, home prices have risen. In fact, during a recent two-year period, prices rose higher and…

-

Alternative mortgage financing: consider a wrap-around mortgage now

Have you heard of a “wrap-around mortgage?” There are other terms for the same type of mortgage but the meaning is that a buyer can come to a buyer with some down payment cash and take over an existing mortgage. There is more to this but the concept works. Wrap-around mortgages are not for everyone.…