Last updated on January 27th, 2025 at 11:23 pm

Real estate agents are independent self-employed individuals subject to federal and possibly state income tax. You need to make quarterly federal tax deposits and quarterly state income tax deposits if your state has an income tax. I suspect that many real estate agents do not understand the quarterly tax deposit requirement.

I know too many real estate agents who have been in trouble with the IRS over not making any deposits for the current and previous years. You get that commission check and think it’s all yours. Wrong.

You have an obligation to yourself to avoid confrontation with the federal or state tax people. The situation can get nasty if you fail to make federal income tax withholding deposits. In addition, your quarterly tax payments must be up to date by tax time in April.

Many of us first start in the real estate business and just try to make ends meet. It’s tempting not to make that quarterly deposit on time. You think, “I will put more in after the next sale”. Those of you who tend to avoid the process will procrastinate. Late payments are subject to penalties, interest, etc. The tax law is tough on people who fail to meet their tax obligations.

Commissions are self-employment income

Something you should know. As of October 2024, Congress has not reauthorized the 2017 tax bill that offered tax breaks and large standard deduction. This means you can not plan on any previous year’s income or expenses to plan for tax year 2025.

The commissions you make are considered self-employment income and just as if you were working for a corporation and paid a salary, you must pay federal income taxes, Medicare taxes, and Social Security taxes. You may receive a refund for all or part of what you have deposited based on your annual tax returns. A self-employed agent is entitled to deductible expenses related to your business such as mileage. Your business income and expenses are a separate IRS form, schedule C.

How to get started with making quarterly tax deposits

To sign up to make quarterly IRS deposits as an independent real estate agent, you’ll follow these steps:

1. Obtain an Employer Identification Number (EIN)

- Even if you’re a sole proprietor, the IRS may require you to have an EIN for tax purposes, particularly when making quarterly tax payments.

- You can apply for an EIN on the IRS website for free through the IRS EIN application page.

2. Determine Your Estimated Tax Payments

- As an independent real estate agent, you are considered self-employed and are responsible for self-employment taxes (covering Social Security and Medicare) as well as income taxes.

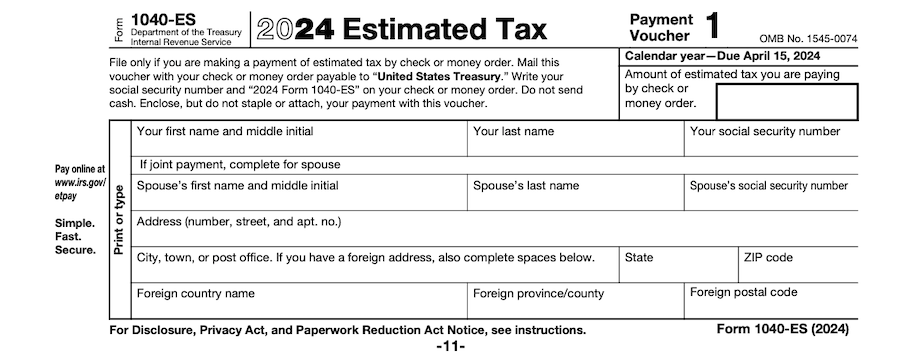

- Use IRS Form 1040-ES to estimate your quarterly tax payments. This form helps you calculate your tax liability, based on your expected income, deductions, and credits.

- You can download the form from the IRS website here.

3. Register for the Electronic Federal Tax Payment System (EFTPS)

- The IRS encourages taxpayers to make quarterly estimated payments through the EFTPS (Electronic Federal Tax Payment System).

- Visit EFTPS.gov to enroll. The system allows you to make tax payments online, via phone, or through their app.

- Once registered, you’ll receive a PIN in the mail. This process can take up to five business days.

4. Set Your Payment Schedule

- You are required to make estimated tax payments four times a year:

- 1st Quarter: April 15

- 2nd Quarter: June 15

- 3rd Quarter: September 15

- 4th Quarter: January 15 (of the following year)

- You can set reminders to avoid missing these deadlines.

5. Submit Payments

- Once you have your EIN and EFTPS account set up, you can start submitting your payments.

- When making a payment, be sure to select the appropriate payment period and indicate that the payment is for “1040ES” (Estimated Taxes).

6. Track Your Payments

- Keep a record of all your payments. The IRS will review your quarterly payments when you file your annual tax return (Form 1040) to ensure you’ve paid enough throughout the year.

By following these steps, you’ll be set up to make your quarterly IRS deposits efficiently and stay compliant with tax regulations. I strongly suggest that you use the link above to the IRS to help calculate your estimated quarterly tax payment.

Set up your state tax deposits

Most states require self-employed individuals, such as independent real estate agents, to make quarterly estimated tax payments if they expect to owe state income taxes. The specific rules for quarterly tax payments vary by state but generally follow the same structure as federal quarterly payments.

Below is a list of states that require individuals to make quarterly estimated income tax payments if their tax liability exceeds certain thresholds:

States that Require Quarterly Estimated Income Tax Payments:

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Utah

- Vermont

- Virginia

- West Virginia

- Wisconsin

- Washington, D.C.

States Without State Income Tax:

Some states do not have an individual income tax, so there is no requirement for state quarterly tax payments:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

Additionally, New Hampshire and Tennessee do not tax earned income but do tax investment income, so their quarterly tax requirements only apply to interest and dividends if above certain limits.

Thresholds and Payment Schedules:

- In most states, quarterly payments are required if you expect to owe more than a certain amount of state income tax (often between $200 and $1,000).

- Payment schedules generally align with the federal deadlines: April 15, June 15, September 15, and January 15(for the following year).

You should check your specific state’s Department of Revenue website for the exact requirements, thresholds, and forms used to file quarterly payments.

Recommendation to manage the estimated tax payment

Real Estate income varies greatly unlike someone on a salary. It’s difficult to plan for income and expenses but not impossible. To further complicate the situation you may have rental property that generates income.

At the same time you are working out how much money you need to deposit quarterly for your commissions, you have to add in all other income. For agents who are buying and selling their properties, there are potential capital gains taxes.

A good thing is that capital gains income is not required to be deposited quarterly. When you are rehabbing a property in one year and selling it in another, you may have sufficient income to legally avoid paying federal taxes in that year.

You may earn a refund. I recommend that you consider leaving that refund with the IRS as an advance against the next year. Here is how leaving the refund in place will help you:

If a self-employed individual is required to make quarterly estimated tax payments and misses one of the payments, but they have a carryover refund from the prior year, whether or not there will be a penalty depends on a few factors:

1. Sufficient Carryover to Cover Estimated Taxes:

- If the carryover refund from the previous year is large enough to cover the amount of the missed estimated tax payment, the IRS typically will not assess a penalty.

- The IRS applies the carryover refund to the estimated tax liability, so if that refund is enough to satisfy the required payment for the missed quarter, no penalty is incurred.

2. Underpayment of Estimated Taxes:

- If the carryover refund is not sufficient to cover the missed quarterly payment, you may be subject to a penalty for underpayment of estimated taxes.

- The IRS requires taxpayers to pay their taxes throughout the year as income is earned, and a significant underpayment could result in penalties, even if you had a carryover refund.

3. Safe Harbor Rules:

The IRS provides “safe harbor” rules to help taxpayers avoid penalties. You won’t face a penalty if:

- You paid at least 90% of the tax owed for the current year through a combination of withholding and estimated payments, or

- You paid 100% of the tax owed for the previous year (or 110% if your adjusted gross income is more than $150,000).

If your carryover refund combined with any estimated payments or withholding meets one of these thresholds, you may avoid a penalty.

4. Annualized Income Installment Method:

If your income fluctuates throughout the year, you can use the annualized income installment method (Form 2210) to calculate your estimated payments based on your actual earnings each quarter. This can sometimes reduce or eliminate penalties if most of your income is earned later in the year.

5. IRS Penalty Waiver:

If you missed a quarterly payment due to circumstances beyond your control (e.g., illness, casualty, disaster), the IRS may waive the penalty. You would need to submit a request for a waiver with an explanation.

Conclusion:

If the carryover refund covers the missed payment, you won’t face a penalty. However, if there is a shortfall, and you don’t meet the safe harbor rules, you might be subject to a penalty for underpayment of estimated taxes.

If you leave the carry-over refund in place and it is sufficient to cover the late payment, keep it in place for the next late payment, etc. You can push it to the end of the year and avoid penalties. This process is similar to a backup to your checking account in case your account has insufficient funds. I have been doing this for years. The IRS will not pay you interest on the amount they are holding but it is like a safety net.

Another good point is that the IRS has red flags that cause them to audit taxpayers. Real Estate agents are much more likely to become the object of a tax audit. The high number of deductions, fluctuating income, cash payments (from rentals), and self-employment filings. All of these are red flags for the IRS to watch real estate agents’ tax returns. Because of the propensity of real estate agents being audited, I strongly recommend the use of a CPA who may be able to forestall a tax audit. More often, the IRS will pass over a tax return from a real estate agent who had a CPA prepare the return.

Create an LLC

I recommend that all Real Estate agents avoid the sole proprietor route and instead form a limited liability company. Obtain a federal tax ID and open a checking account. You can read more in this article. The limited liability company or LLC form of business ownership for real estate agents that offers many benefits including a much cleaner process for income tax purposes.

Keep your personal expenses and income outside of your account. You can even become an employee of your own LLC. When the government was giving free COVID money to companies to pass through to their employees, real estate agents who were employees of their oLCs qualified for free money.

While you can do your taxes, I suggest that you seek tax advice from a CPA and have your CPA complete your income tax return.

Real estate professionals who use the LLC business form should establish an accounting system to track business-related purchases, business expenses, rental income, and real estate income (use a mileage tracker, this is a big deduction).

Every transaction should be recorded. At the end of the year, the easiest way to get your income taxes completed is to provide access to your accounting system for your CPA.

Leave a Reply

You must be logged in to post a comment.